Eight Signs You Need to Hire an Accounting Professional

One of the most common reasons that businesses fail is financial issues. Many times, it is due to a lack of funding. However, do not get fooled into thinking that you’re fine just because you have a loaded bank account or are making a ton of sales. Large accounting numbers don’t automatically mean you are doing well financially and have nothing to worry about. You could be sabotaging yourself financially and not even know it until it is too late.

Save yourself a lot of frustration and stress by keeping an eye out for these eight signs that it’s time to hire an accounting professional.

You have a new business, and you are doing everything yourself. That’s ok! You aren’t alone in being a one-person show as you get your business up and running. However, there might be a time when you need to let go of the reins and start trusting people to take over certain sectors of your business. If you’re willing to hire sales, marketing, supply chain, and HR managers, why not hire an accountant as well?

You are probably smart and savvy enough to manage your personal finances, and you’ve managed to gather funding and get your business up and rolling. This doesn’t mean you can’t get help managing your business finances once your business grows beyond a certain point. It is not a sign of failure to hire an accountant; it is a sign of wisdom and confidence. With a knowledgeable accountant, you have professional guidance to strategically grow your business.

2. You Are Going Cheap

It is ok to be frugal, but it’s not ok to be penny-wise and dollar stupid. There’s a point when being super cheap will start costing you money. If you’re doing your own accounting, it is time to take a hard and honest look at yourself. If you agree with the saying “you get what you pay for”, then what are you delivering as an accountant? If you don’t have professional accounting training or experience, then being cheap and doing it yourself is doing your business a disservice.

3. Small Expenses Are Falling Through the Cracks

You’re human, so you aren’t perfect, and mistakes happen. The odd missed receipt is one thing; regularly losing receipts or not knowing what expenses are valid is a problem. Small purchases add up quickly, and suddenly you are trying to account for thousands of dollars in unaccounted-for purchases. This will be an even bigger problem should the IRS come asking you for the documentation behind your claimed expenses.

4. You’re Immediately Writing Off Major Purchases

Do you know the difference between a small and a big purchase? Of course, you do! The real dilemma is knowing the different methods for handling these expenses. It’s ok to immediately write off $250 worth of office supplies. These items are regularly and routinely replenished because you’re using them quickly. It’s different if you use that $250 to buy a new fancy office printer. This is an asset that you won’t use up quickly. Instead of immediately writing off the purchase, you’ll account for depreciation over the useful life of the printer.

Knowing the difference isn’t about the amount of money you spend. For example, you could spend $1,000 on office supplies and immediately write it off while spending $200 on a desk that you will depreciate over time. An accountant knows and understands the nuances of writing off purchases.

5. You Don’t Have a Backup

No one thinks about making a backup until they need one. Don’t get yourself and your business hemmed up by not having a backup of your financials. All it takes is one computer glitch or accidentally throwing away your “receipt box”, and everything is long gone. It’s always best to have two separate copies and active backup processes in place.

Professional accountants have your back by utilizing software with fail-safes that automatically back up your data. This gives you an even greater level of security. You have a copy, the accountant has their working copy, and they have their backup system.

6. You Have No Review or Audit Process

There should be a checks-and-balances process in place to hold you and everyone else accountable. It doesn’t matter if you are the one doing the books or someone else is completing this task. When one person is solely responsible for managing the finances of a company, problems can happen. It could be ineptitude and mistakes going uncaught. It could also be ill intentions and fraudulent activity going unchecked. If you had a review or audit process in place, both these situations would get caught early on, preventing major problems later.

Hiring an outside accounting firm can ensure you have an outside third-party performing your reviews and audits. This holds everyone accountable because the firm only has an interest in ensuring your accounting is correct and complete.

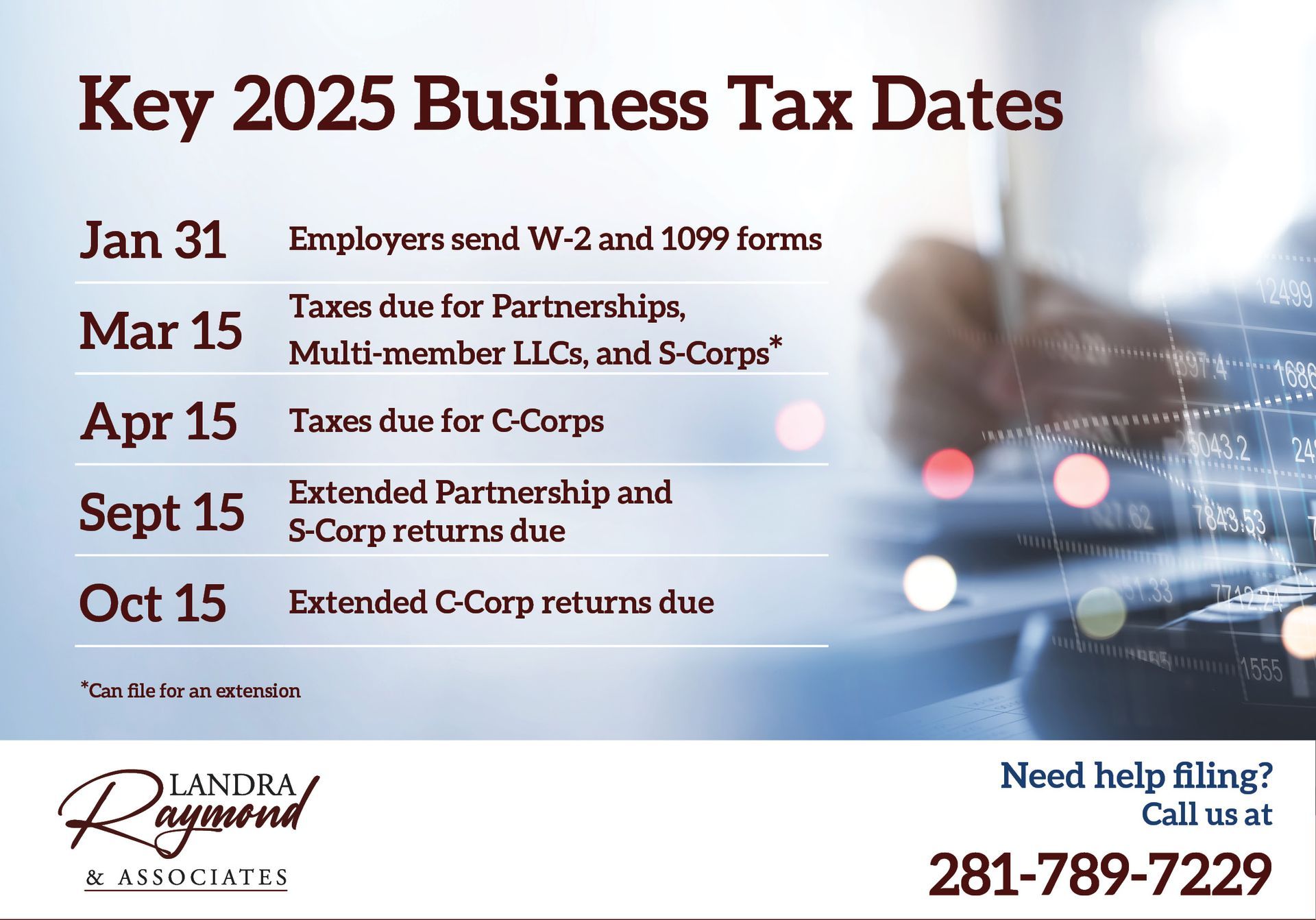

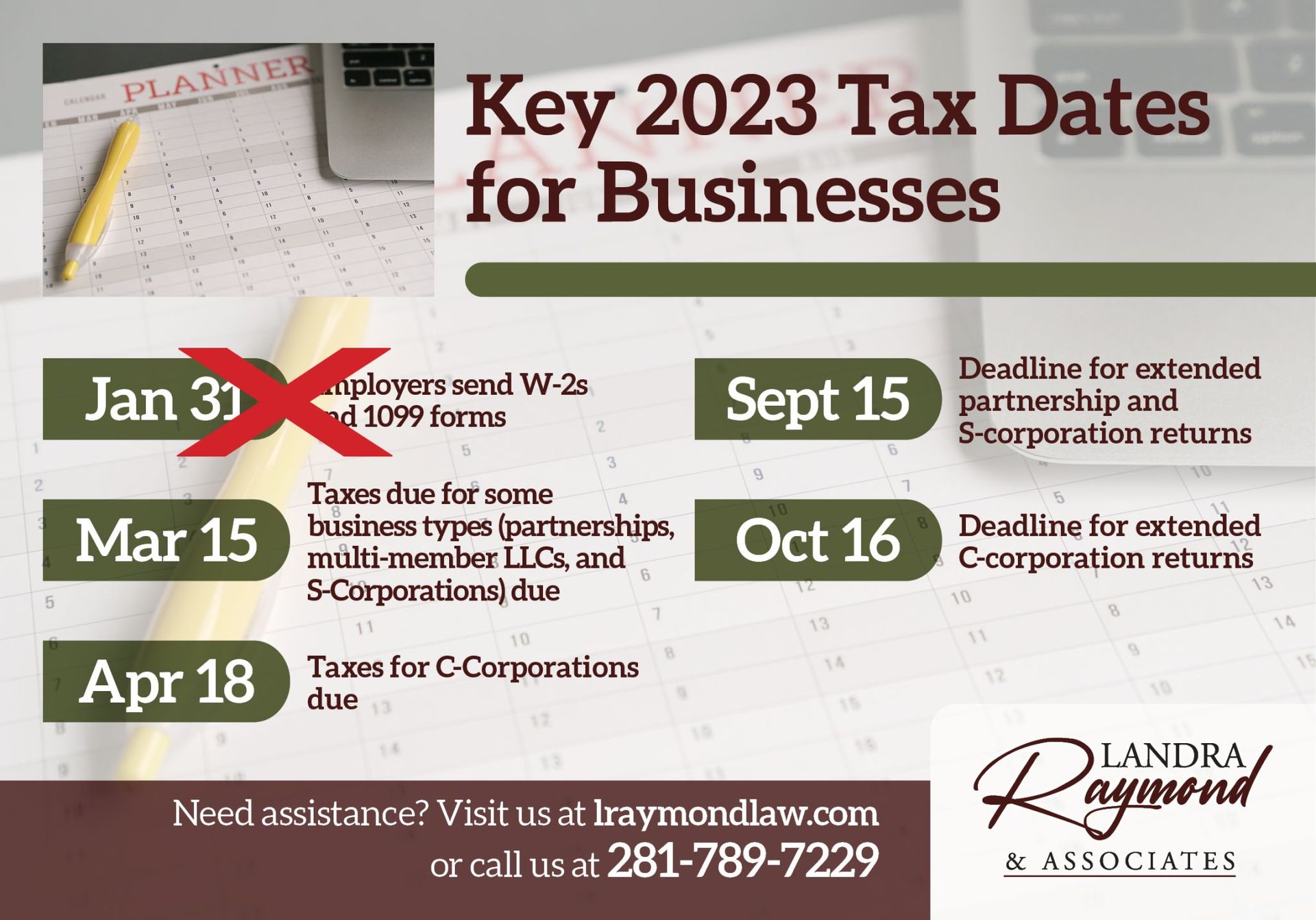

7. You’re Falling Behind

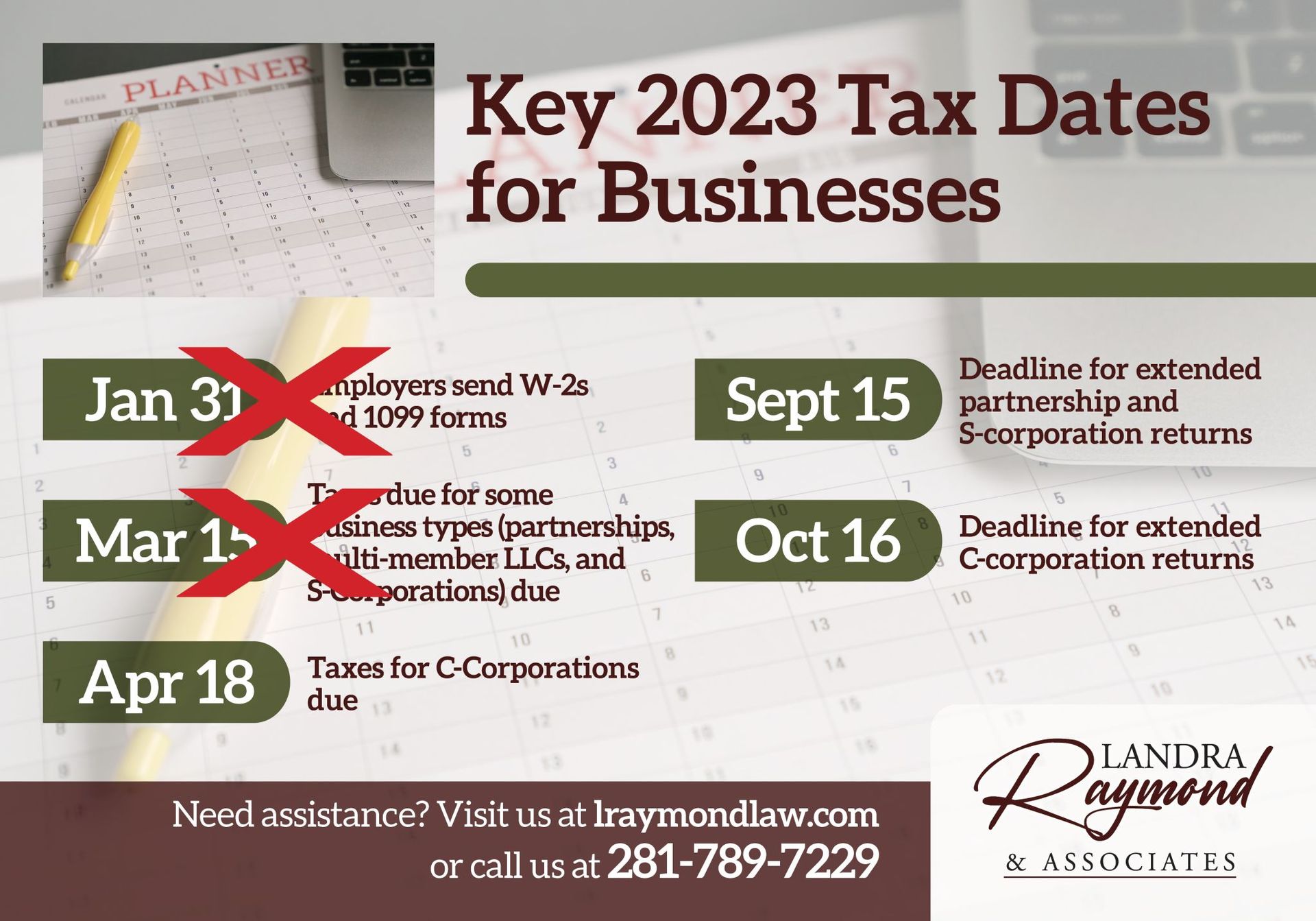

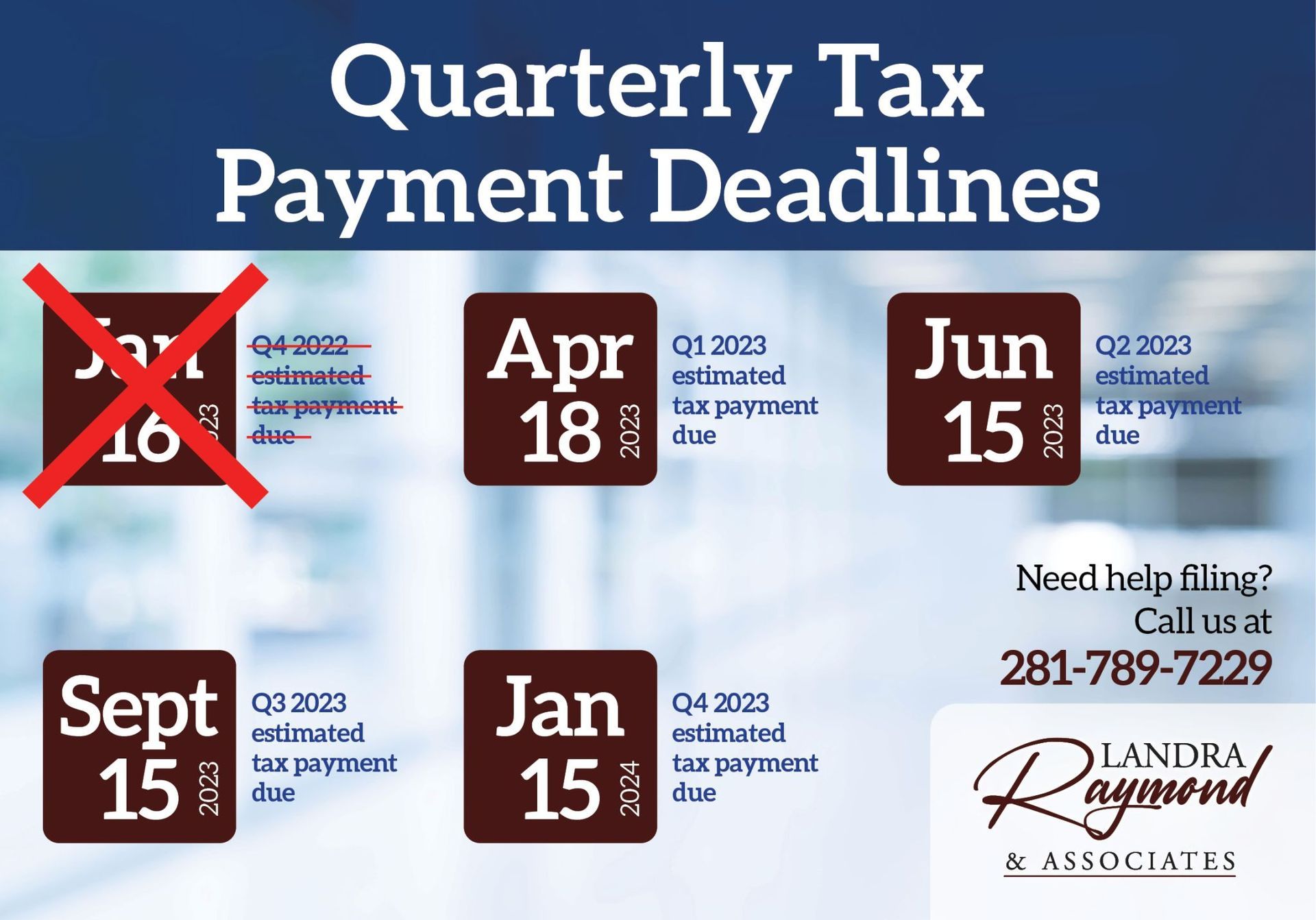

IRS deadlines are not a suggestion. The IRS doesn’t have a sense of humor and isn’t interested in excuses as to why you missed their deadline. Additionally, your vendors don’t appreciate you missing their payment deadlines either. How would you like it if your business is owed a large chunk of money and you’re just getting handed excuse after excuse? You’d dump that client pretty quickly, right? So why are you letting your relationships suffer by not keeping up with your financial obligations?

Hire an accountant to manage your cash flow. No more wasting time fielding inquiries from people who want their money. No more wasting money on IRS penalties for missing deadlines. No more suffering relationships from not keeping your word or timely fulfilling your contractual duties.

8. You Don’t Know the Law

Just because you know how to manage your personal finances or file your own taxes, doesn’t mean you know what you are doing when it comes to corporate finances and taxes.

For example, you can include claims for charitable contributions on your personal taxes, but this isn’t a possible claim for your business taxes. Typically, when a business makes a charitable contribution, they get something in return. This return moves the contribution out of the charitable arena and into a mutually beneficial business agreement. Even if all you’re getting is advertising space, recognition, or some other concession. The IRS won’t take kindly to you claiming charitable tax dedication on your business taxes when you’re getting a benefit from your efforts.

This is just one example of the numerous laws and regulations that you need to follow as a business owner. You could spend hours of time and effort learning the law, which also means taking your attention away from the core purpose of your business. The easier and more logical course of action is to hire an expert and leverage their skills and expertise so that you can focus on what you know best.

Hire An Accounting Professional

If you’re seeing one or more of these eight signs, then you probably need to stop being a one-person show and hire an accounting professional to help with your business finances. They can help you set up an auditing and review process, establish a backup system, show you how to take advantage of accounting laws and regulations, and much more.

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help. We’re here to help and would love to hear from you! So, make an appointment, and let’s figure out how to improve your accounting practices.