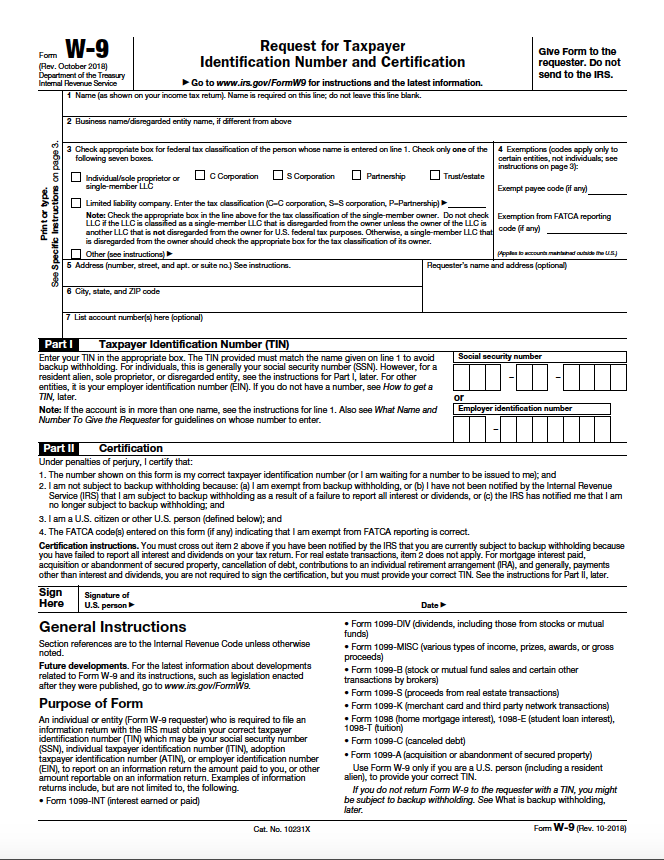

Use Form W-9 to provide your correct Taxpayer Identification Number (TIN) to the person who is required to file an information return with the IRS to report, for example:

• Income paid to you.

• Real estate transactions.

• Mortgage interest you paid.

• Acquisition or abandonment of secured property.

• Cancellation of debt.

• Contributions you made to an IRA.

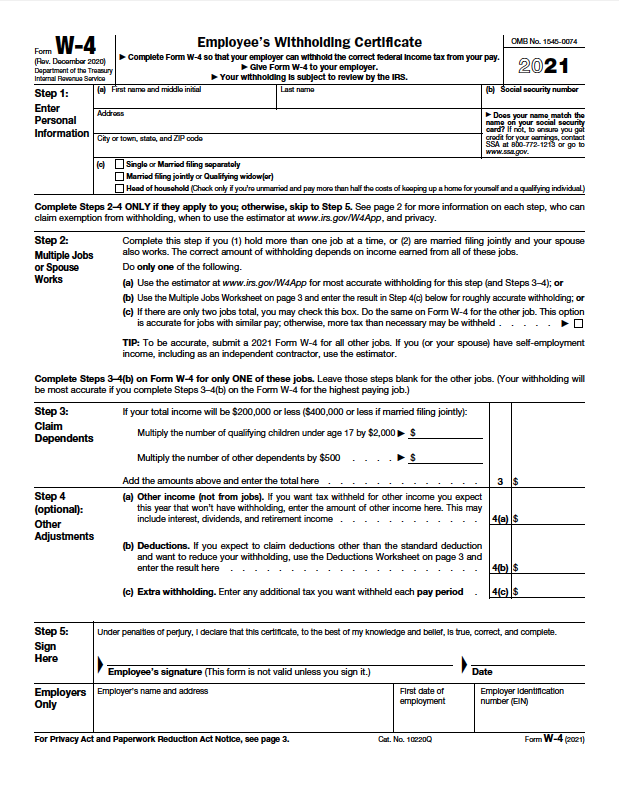

Complete Form W-4 so that your employer can withhold the correct federal income tax from your pay. Consider completing a new Form W-4 each year and when your personal or financial situation changes.