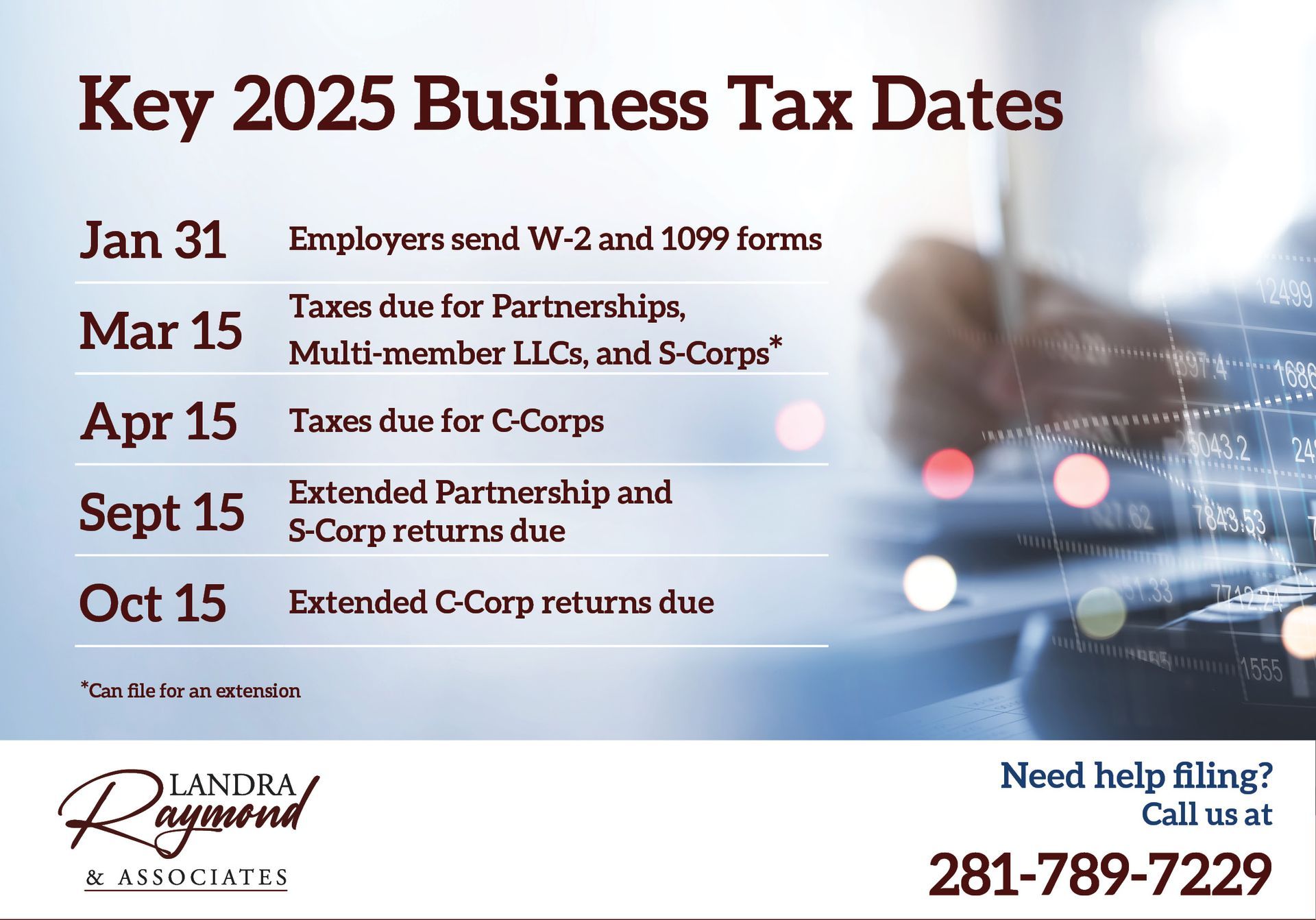

The last major business tax deadline is October 16, when your extended C-corporation returns are due. Are you ready to submit everything to the IRS? With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Are you ready to submit your extended partnership and S-corporation returns? The deadline is September 15, and will be here shortly. With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines. The next deadline is Oct 16: extended C-corporation returns due.

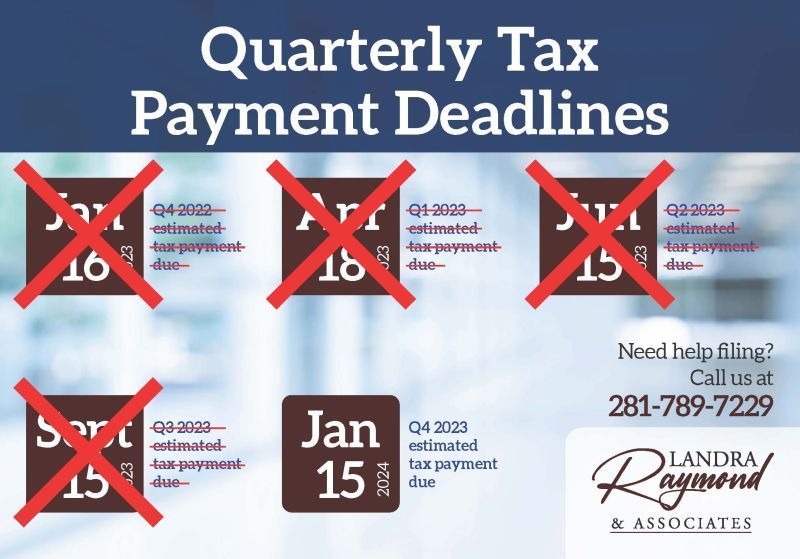

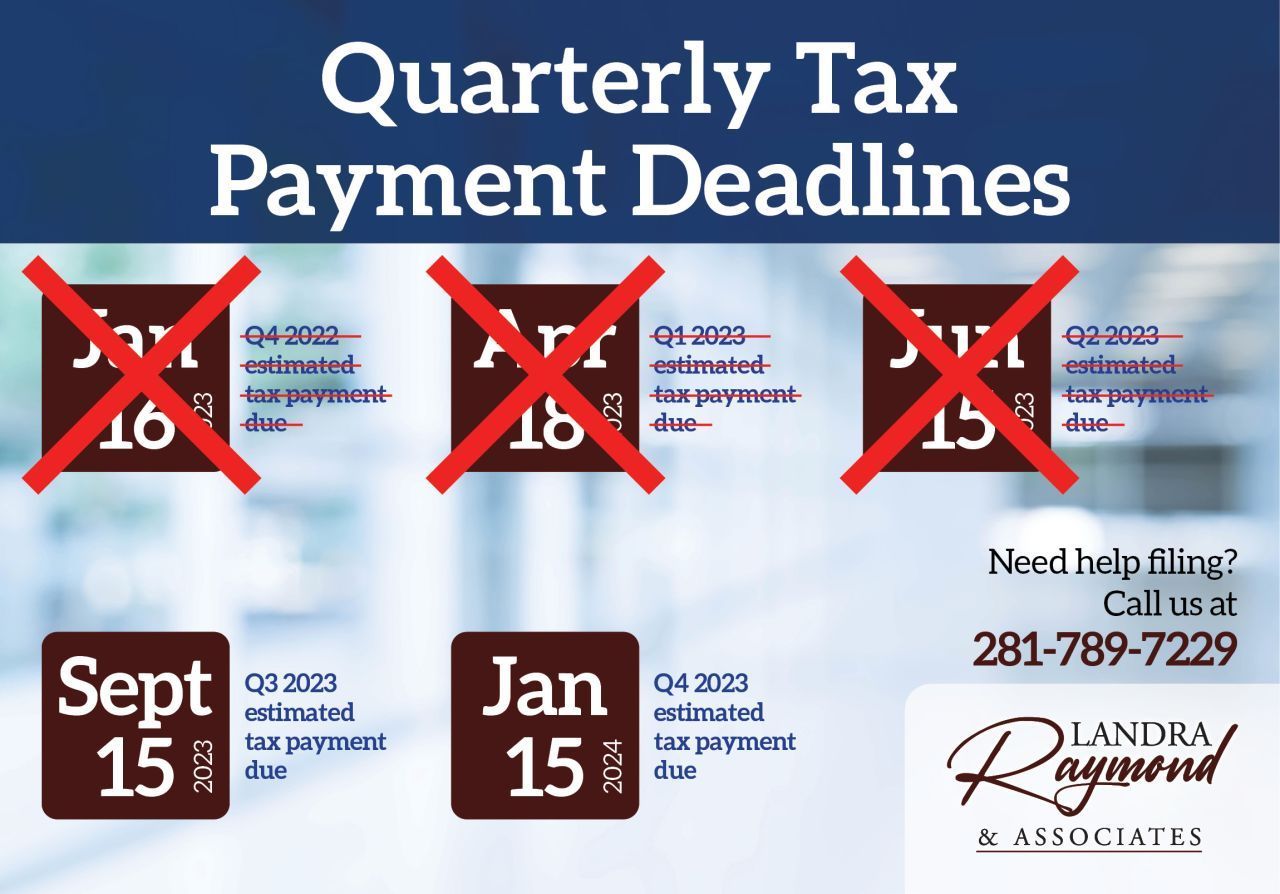

Are you ready for the next quarterly tax payment deadline as a business owner? - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.