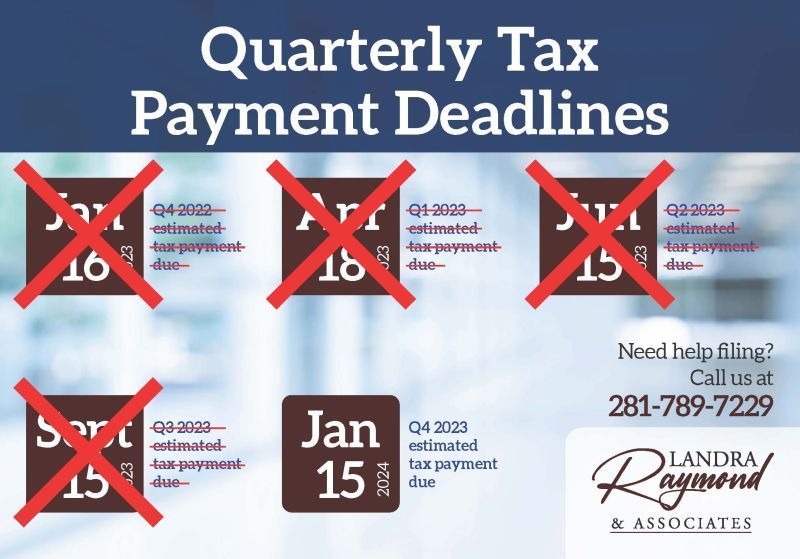

Q4 2023 Estimated Tax Payments Due 1/15/24

Are you ready for the last quarterly tax payment of 2022 as a business owner?

- January 15: Q4 2023 estimated tax payment due

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

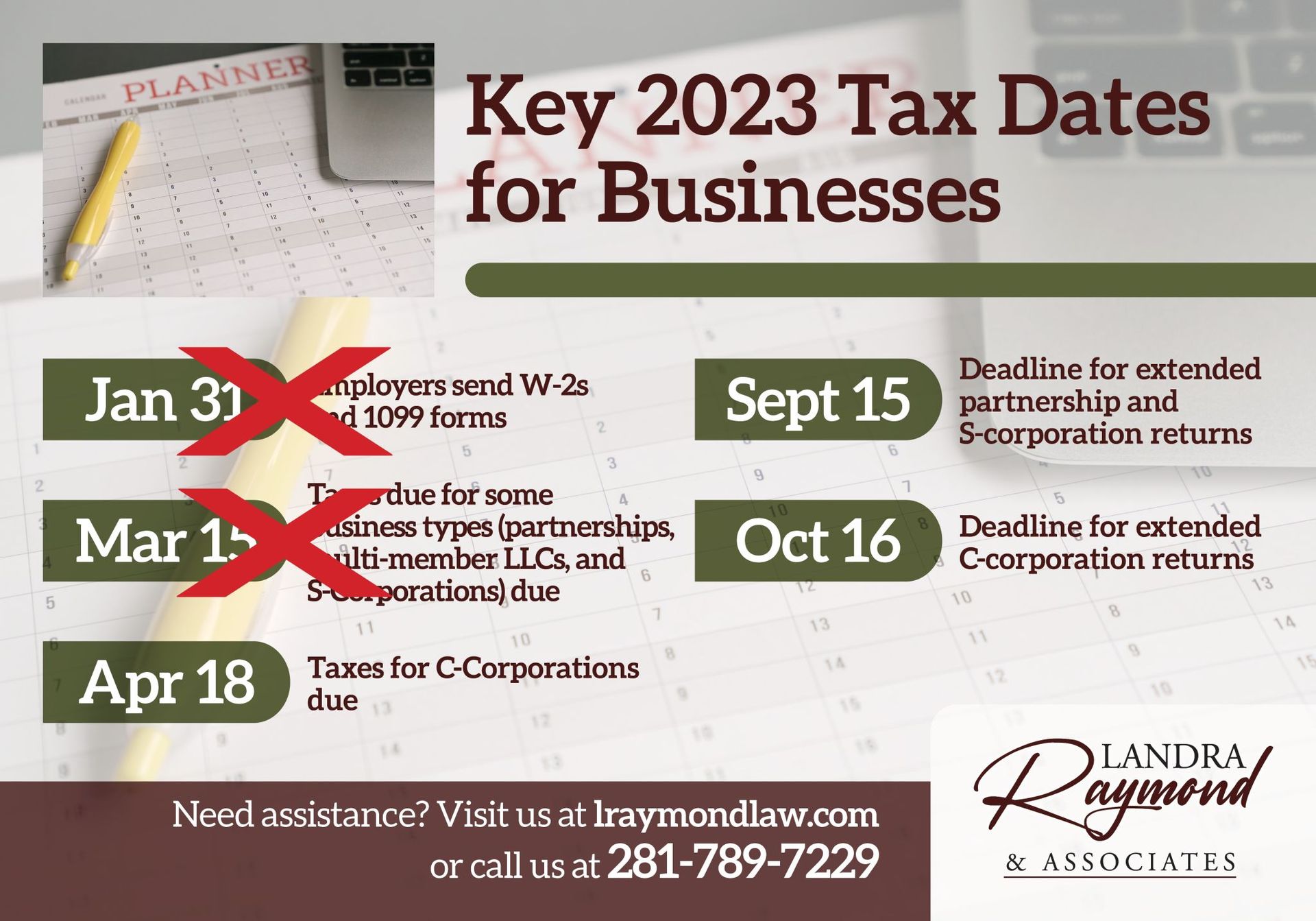

The last major business tax deadline is October 16, when your extended C-corporation returns are due. Are you ready to submit everything to the IRS? With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

Are you ready to submit your extended partnership and S-corporation returns? The deadline is September 15, and will be here shortly. With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines. The next deadline is Oct 16: extended C-corporation returns due.

Are you ready for the next quarterly tax payment deadline as a business owner? - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

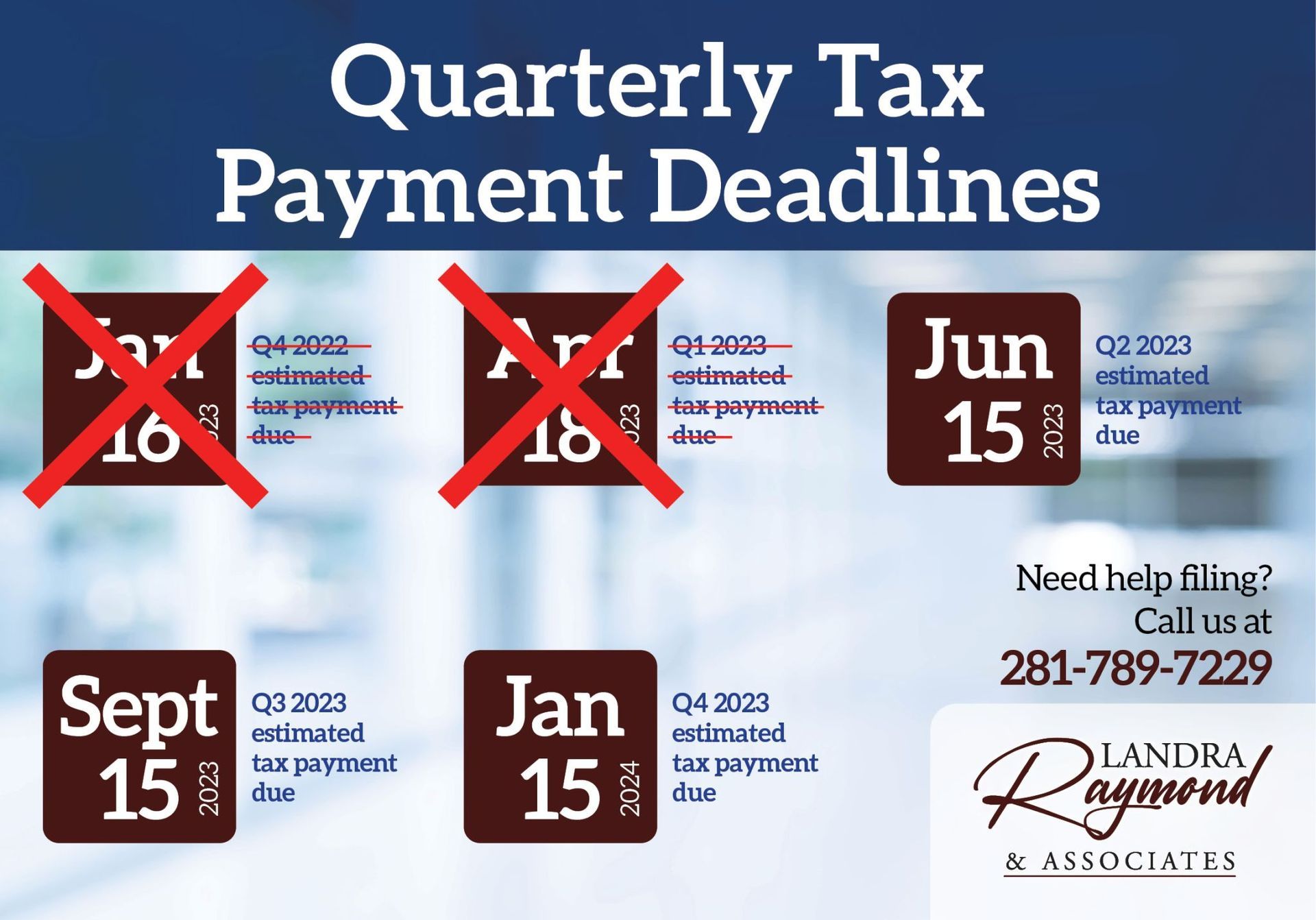

Are you ready for the next quarterly tax payment deadline as a business owner? - June 15: Q2 2023 estimated tax payment due - September 15: Q3 2023 estimated tax payment due - January 15: Q4 2023 estimated tax payment due With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

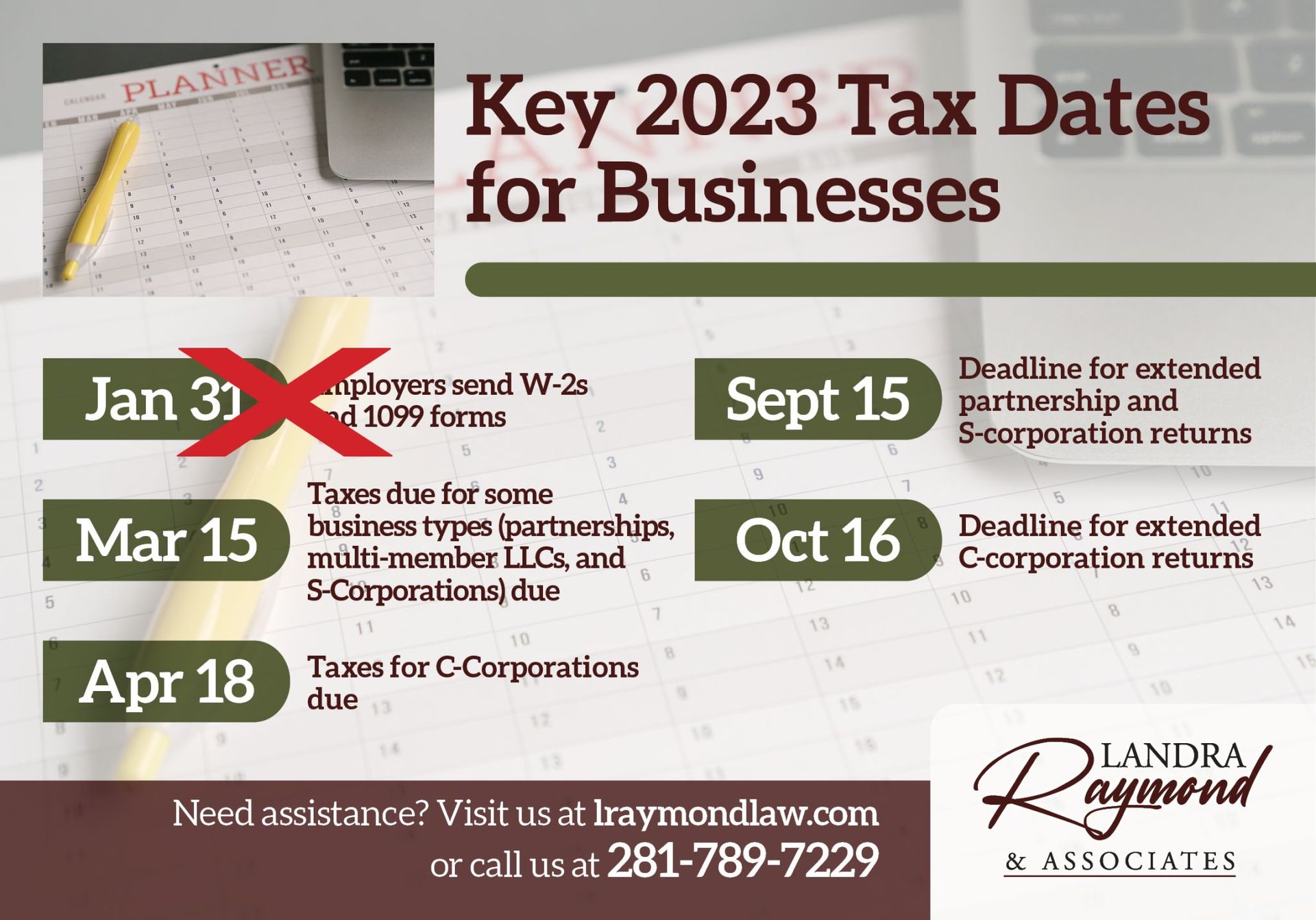

Taxes for C-Corporations are due on April 18. Are you prepared to send everything to the IRS? With decades of experience dealing with accounting, tax, and legal project s, the Landra Raymond & Associates team can help ensure you're ready for deadlines. Future deadlines include: - Sept 15: Deadline for extended partnership and S-corporation returns - Oct 16: Deadline for extended C-corporation returns

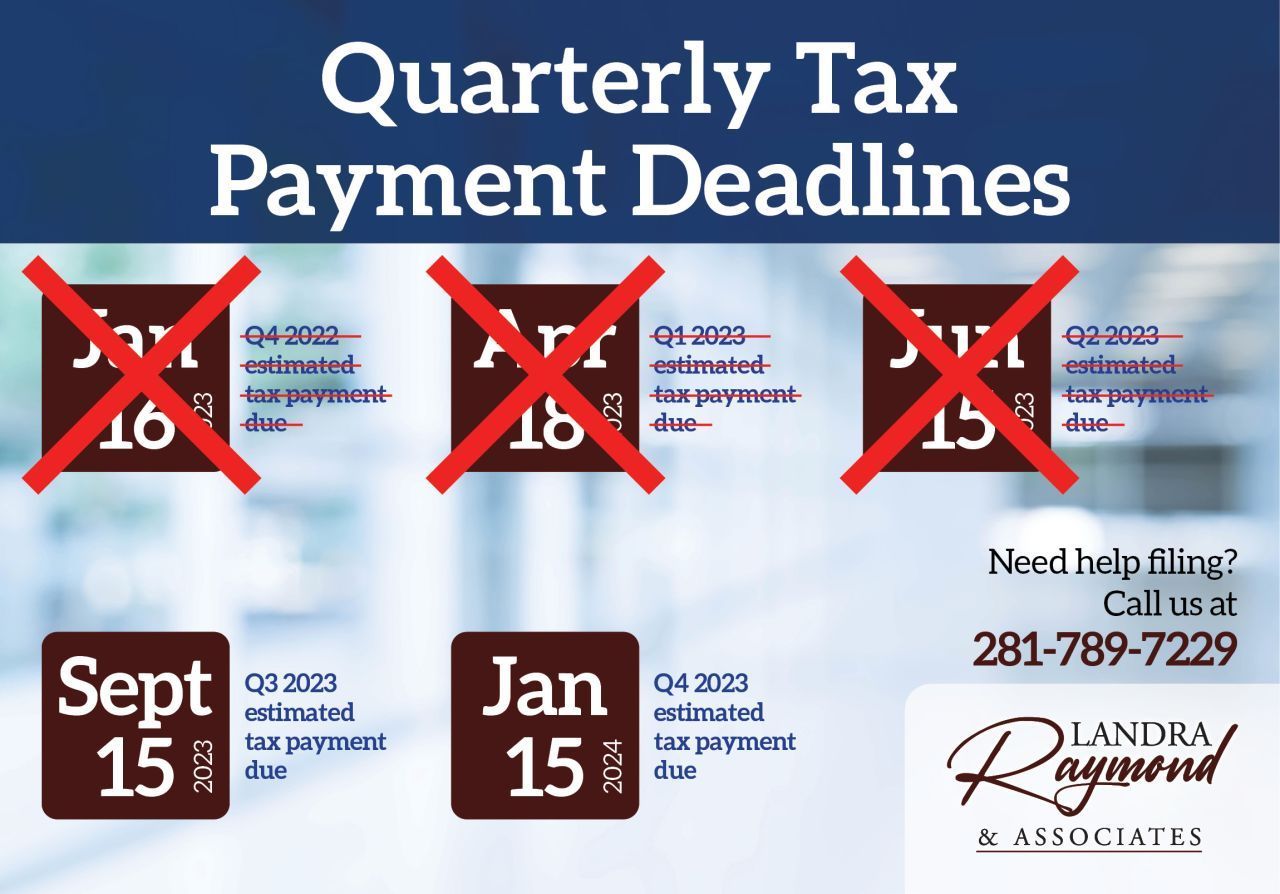

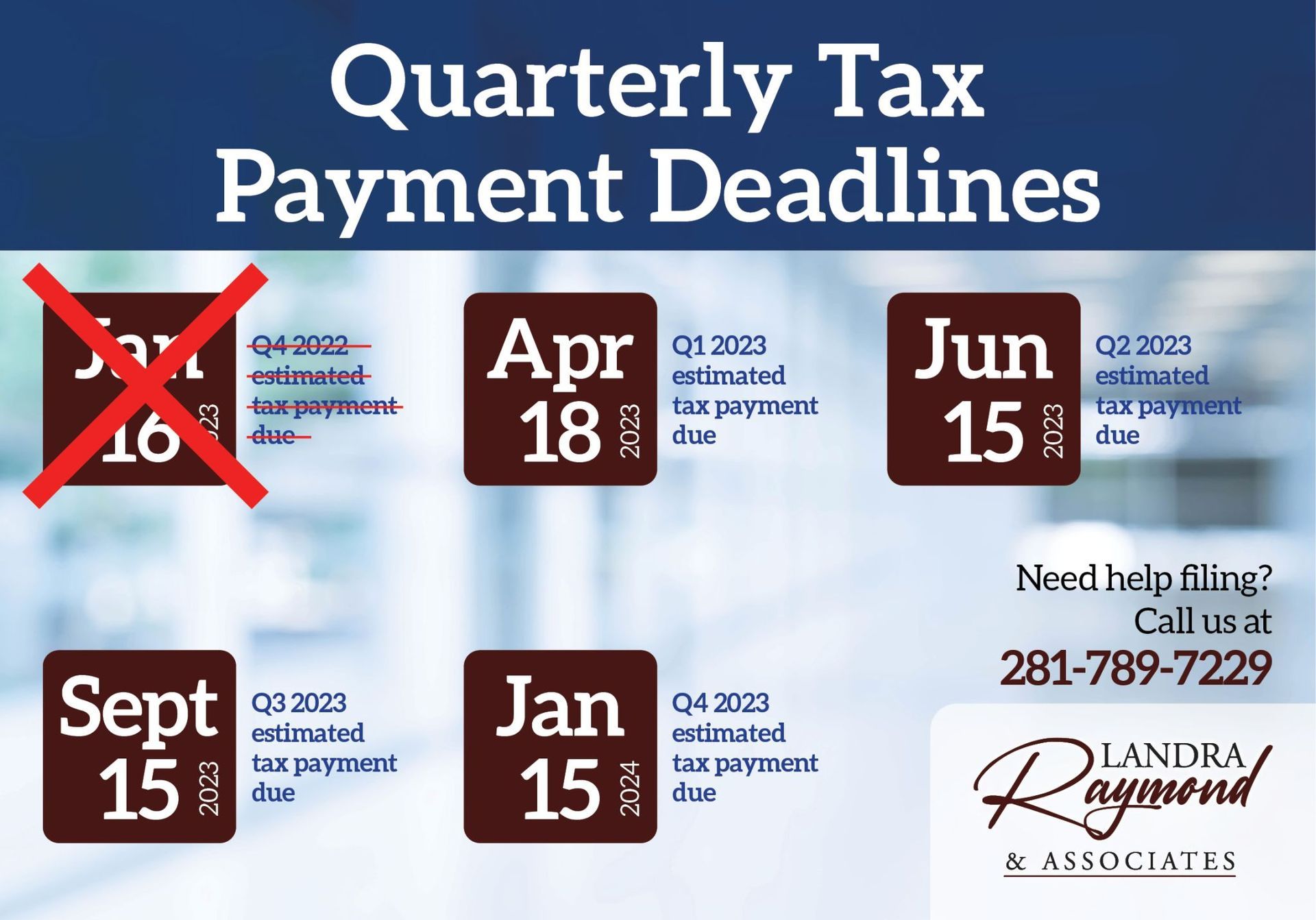

As a business, are you ready for quarterly tax payment deadlines?

- April 18: Q1 2023 estimated tax payment due

- June 15: Q2 2023 estimated tax payment due

- September 15: Q3 2023 estimated tax payment due

- January 15: Q4 2023 estimated tax payment due

With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help ensure you're ready for deadlines.

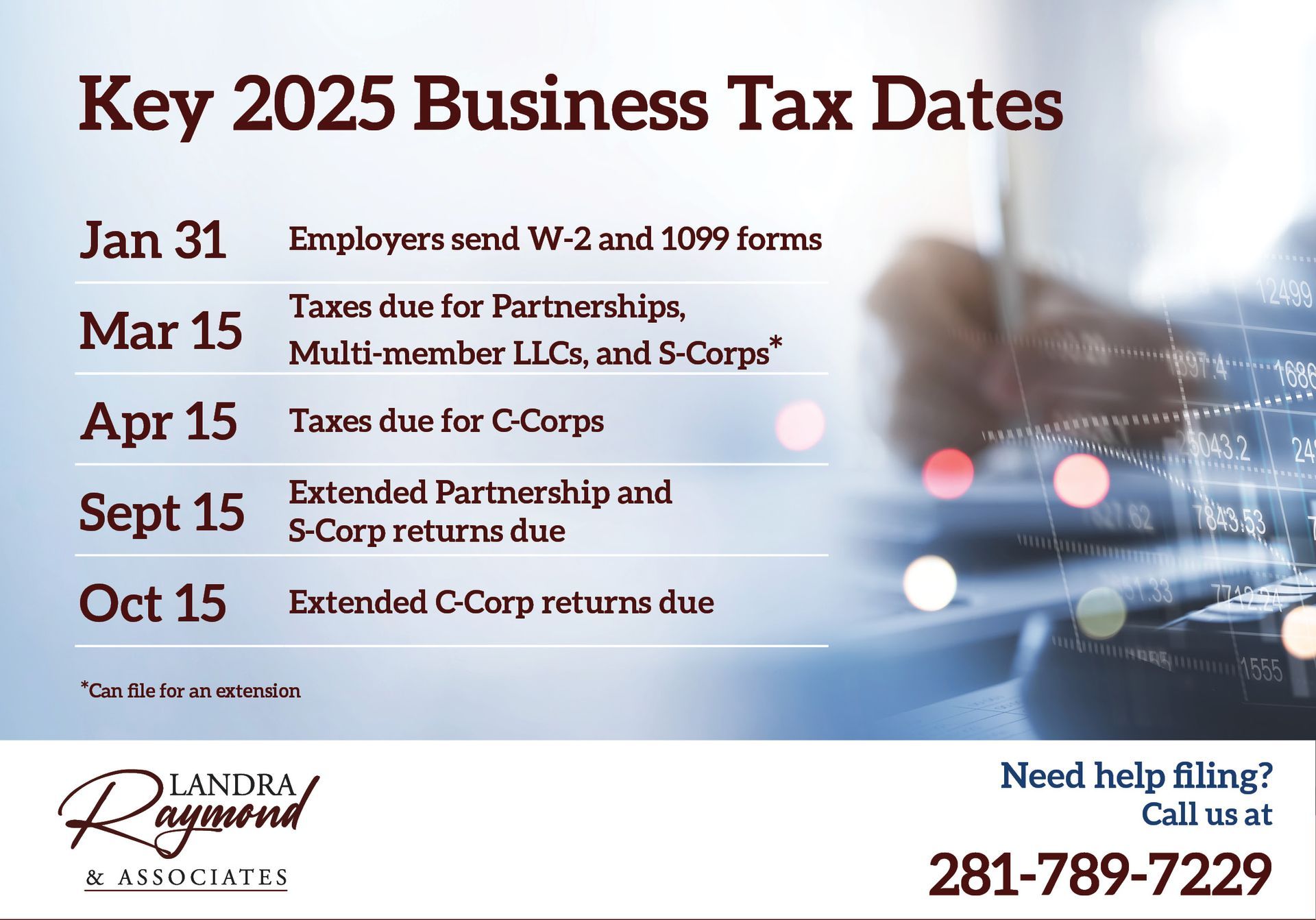

As a small business owner, you wear many hats, from accounting to sales. Managing all business aspects can be stressful enough, but then tax season comes along. While some people may worry, filing taxes doesn’t have to derail you. By preparing early, you can be confident that you have handled tax season. Separate Personal from Business Small business owners' biggest mistake is mixing their personal and business expenses. Not only does this expose your personal assets to unnecessary risk, but it also makes managing your finances more difficult. If you haven’t done so already, separate your personal and business expenses and open different accounts for the company. Funnel all payments and costs for the business through these accounts. Do not use your personal cards for the business. Instead, take out a separate credit card in the business name. Gather and Organize Your Records You can’t begin to file taxes if you don’t have your documents in order. The best solution is to organize everything from the beginning, but not every small business owner does this for various reasons. If you fall into this category, try starting sooner rather than later, or you may encounter delays in filing. Digitize Protect your documents by making a digital copy of them. Save PDF files for all your receipts, purchase orders, and accounting-related documents. You can then organize the documents into folders, making it easier to find what you need months or even years later. It also saves you from carting a large box of papers around. Use Accounting Software If you haven’t already done so, start using accounting software for the business. This gives you a centralized location where you can manage all your business accounting in one place. Look for software that is designed for small businesses. It should be simple to use, affordable, and scalable to grow with your business. Review Payroll If you are the only person who works for your business, you can skip this step unless you are paying yourself a W2. You will need to review your payroll if your small business has employees. Your business should have remitted taxes, which means withholding a percentage of each employee’s paycheck for tax payments. If you or your payroll service didn’t withhold taxes, your business could be on the hook for these, which could inflate your tax liability. Collect Documents Whether you file your taxes or have help from an accountant, you will need all your business documents to file taxes correctly. Making sure you have everything organized and ready when you meet with your accountant will make things easier for everyone. Taxpayer identification number (EIN or SSN) Income statement Balance sheet Receipts Bank statements Credit card statements Payroll records Previous year’s tax return Estimated tax payments Check Your Deadlines Everyone knows April 15 as Tax Day. However, this isn’t the only deadline that the IRS has. The deadline could be different depending on what you are filing and the entity under which you are filing. For example, if you are self-employed, your final deadline for making an estimated tax owed payment is January 17, 2023. Your federal tax return filing deadline can differ depending on your small business formation. Sole proprietorships: Schedule C and personal tax return: April 17, 2023 Partnerships: IRS Form 1065: March 15, 2023 Multimember LLCs: IRS Form 1065: March 15, 2023 S-corporations: IRS Form 1120S: March 15, 2023 C-corporations: IRS Form 1120: April 17, 2023 Similarly, extension deadlines can vary based on your small business filing status. While you may have the best intentions to file your business taxes on time, this doesn’t always happen. Do not rush to file a tax return that isn’t complete and correct. Instead, filing for an extension can give you extra time. Sole proprietorships: October 16, 2023 Partnerships: September 15, 2023 Multimember LLCs: September 15, 2023 S-corporations: September 15, 2023 C-corporations: October 16, 2023 Finally, if your small business has employees or works with independent contractors, be aware of the January 31 deadline, which is the day you need to send out W-2s and Form 1099-NECs. Consider Tax Deductions Businesses can claim different tax deductions than individuals. These can vary based on your business filing status. Your accountant can help you understand what deductions and credits are available to you. Below are some of the common deductions that are available to small business owners. Business mileage Home office deductions Travel deductions Disabled access credits Small business health insurance tax credits Charitable contribution deductions Hire a Professional Tax law can become an overwhelming and consuming web of regulations. Rules can change from year to year, making things even more confusing. Because of this, you shouldn’t assume that everything is the same as in previous years. Talk with a tax professional who can guide you on the latest tax changes. They make it their job to know the changing IRS laws and how they might affect their clients. As tax deadlines loom closer, tax professionals’ schedules become more hectic and demanding. Scheduling your consultations and meetings early helps you get ahead of the ball and avoid unnecessary stress. Check Your Business Filings Before filing your taxes, check your business status to know what forms you’ll need. Additionally, this is an excellent time to confirm your business status. All too often, individuals choose a business status and then never look at it again. This can create problems later. For example, a sole proprietorship may have been the best choice when you first started the business. However, a few years in, this may no longer be the best status for your small business. Tax season is a good time for this evaluation because you can compare tax liabilities. You may find that your future planned small business growth should also include changing your business status. Can You Afford Your Tax Liability? Depending on your situation, you may find yourself owing the IRS. If this happens, you need to have a plan for how you will pay. You'll need to arrange for payments if you can’t afford to pay your tax liability in one lump sum. There are a few options available. Arrange for a monthly installment payment to the IRS Offer a compromise (tax debt settlement) Request a payment postponement Get Ready for the Next Tax Season With the new year starting, there is no better time than the present to start prepping for tax season. Start by gathering your financials and tax documents. Get your business records in order. Confirm your business status and the applicable deadlines. Once you have everything in order, reach out to a professional. They can help you determine what’s missing and prepare your tax documents for the filing season. Schedule an appointment today and get ready for the next tax season with our team of experienced professionals.