Are You Up to Date on Upcoming Tax Law Changes?

No one wants to file taxes, but it is a necessary thing to do. While paying taxes may seem like an unpleasant part of life, getting audited or paying penalties is much worse. Because of this, you want to ensure you follow the letter of the law and all applicable regulations. This seems like an easy task until you realize that tax laws change every year.

Don’t let upcoming changes in tax law scare you. Thankfully, there is still time to familiarize yourself with the changing laws before the next tax season.

Child Tax Credit

Parents who filed and received the child tax credit for the 2021 tax year enjoyed an increase, but those increases were only temporary. For 2022, the child tax credit will go back to pre-Covid levels. Children that are 17 no longer qualify because the age limit goes back to 16.

The credit is only partially refundable for some tax filers. The total credit amount also drops to $2,000. Many parents appreciated the monthly advance payments that were distributed throughout 2021. That is no longer happening in 2022.

Child and Dependent Care Tax Credit

Like many other tax laws on this list, this tax credit includes significant changes in 2022. Many taxpayers were happy with the overhaul this tax credit got for 2021. In 2021, the credit was worth 20 to 50% of up to $8,000 in eligible expenses for one child/dependent and up to $16,000 for two or more children/dependents. It was also fully refundable.

Unfortunately, it’s no longer refundable in 2022. The maximum credit also drops from 50% to 35%. The list of eligible expenses also got shorter. The total value of costs also decreased to $3,000 for one child and $6,000 for more than one.

The biggest change to this credit is who qualifies. In 2021, families making less than $125,000 per year qualified. In 2022, the full child and dependent care credit will only be allowed for families making less than $15,000 a year.

Earned Income Tax Credit

If you don’t have children, it can feel frustrating as you are disqualified from many other tax credits. However, the 2021 tax year brought something to celebrate, with more than ever qualifying for the earned income tax credit (EITC). Unfortunately, the expanded eligibility requirements go back to their original limits. Many people that were eligible in 2021 will find themselves ineligible in 2022. For example, in 2021, tax filers 19 and older could qualify. In 2022 you need to be between 25 and 65.

However, there is some good news. Those who do qualify will get more than last year. This is because the amounts given have increased to account for inflation.

But there is one more catch. The EITC has phase-out ranges based on your filing status and adjusted gross income (AGI). So, you will need to check your filing status and AGI before assuming you qualify.

Recovery Rebate Credit

During Covid, many Americans received stimulus checks. In 2021, a third one went out that gave people up to $1,400 plus an additional $1,400 for each dependent in the family. Unfortunately, some people did not get the total amount of the third stimulus check or did not get anything at all. If this happened, you could still get the relief through the recovery rebate credit. Since we are not getting any more stimulus checks, this tax credit is no longer in effect.

Premium Tax Credit

If you purchase health insurance through the marketplace (HealthCare.gov), you can get help with your insurance premiums. However, who applies can get tricky because of the changing and complicated laws. For example, enhancements helped unemployed people in 2020 and 2021. Those enhancements do not apply in 2022.

There is an enhancement extension that extends through 2025. But the eligibility requirements that applied in 2021 are no longer in effect. Be aware: just because you qualified in 2020 or 2021 doesn't mean you will automatically be eligible in 2022.

Tax Brackets

The term tax brackets get thrown around, leading to confusion and misunderstandings. Tax rates do not change, but the range for each tax bracket can. For the 2022 tax year, they have gotten wider because of inflation.

Tax rates range from 10% to 37%. There are also three filing statuses: single, head-of-household, and married-filing jointly. For each group, an income range applies to each tax rate percentage.

Long-Term Capital Gains Tax Rates

If you own stocks and investments, you will want to know about the changes to the long-term capital gains tax. These are the profits you make from the sale of capital assets that you’ve owned for at least one year. The tax rate does not change from 2021 to 2022.

However, what does change is the income thresholds to qualify for specific rates. The changes were made to account for inflation. If you are filing as a single individual with income up to $41,675, your rate is 0%. Head-of-household filers can earn up to $55,800, and joint returns can earn up to $83,350 to qualify for 0%.

The tax rate jumps to 20% if your income level reaches certain levels.

● $459,751 for singles

● $488,501 for heads-of-household

● $517,201 for couples filing jointly

Standard Deduction

For most people, the standard deduction is the best option. It will give them a more significant return than opting for itemized deductions. For 2022, the deduction amounts have increased to account for inflation.

● Married couples get $25,900, plus $1,400 for each spouse aged 65 or older

● Singles get a $12,950 standard deduction, plus $14,700 for individuals aged 65 or older

● Head-of-household gets $19,400, plus $1,750 for those aged 65 or older

● Blind people earn an extra $1,400 to their standard deduction

1099-K Forms

Filing taxes as an independent contractor or freelancer just got easier, thanks to the 1099-K form. Third-party payment processors like Venmo and PayPal will send you a Form 1099-K if they process more than $600 in payments for you throughout the year. In the past, you had to receive $20,000 in payments and process more than 200 transactions.

Charitable Gift Deductions

The charitable deduction credit for cash expired in 2021. This deduction was only available to those who opted for the standard deduction, not the itemized one. The 60% limit is also back in place. It was suspended during the 2020 and 2021 tax years. So now, if you take itemized deductions, keep in mind that there is a 60% AGI limit.

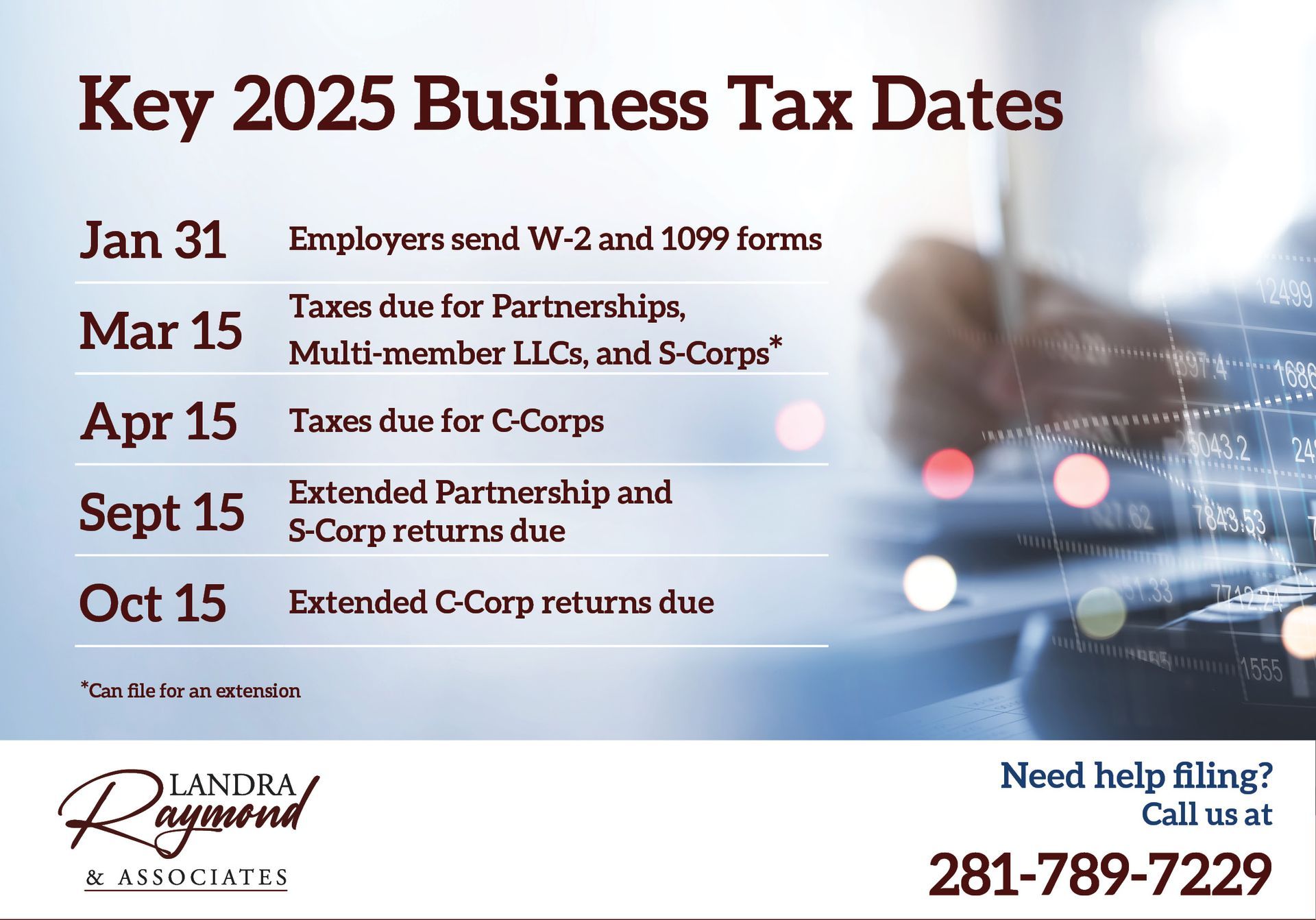

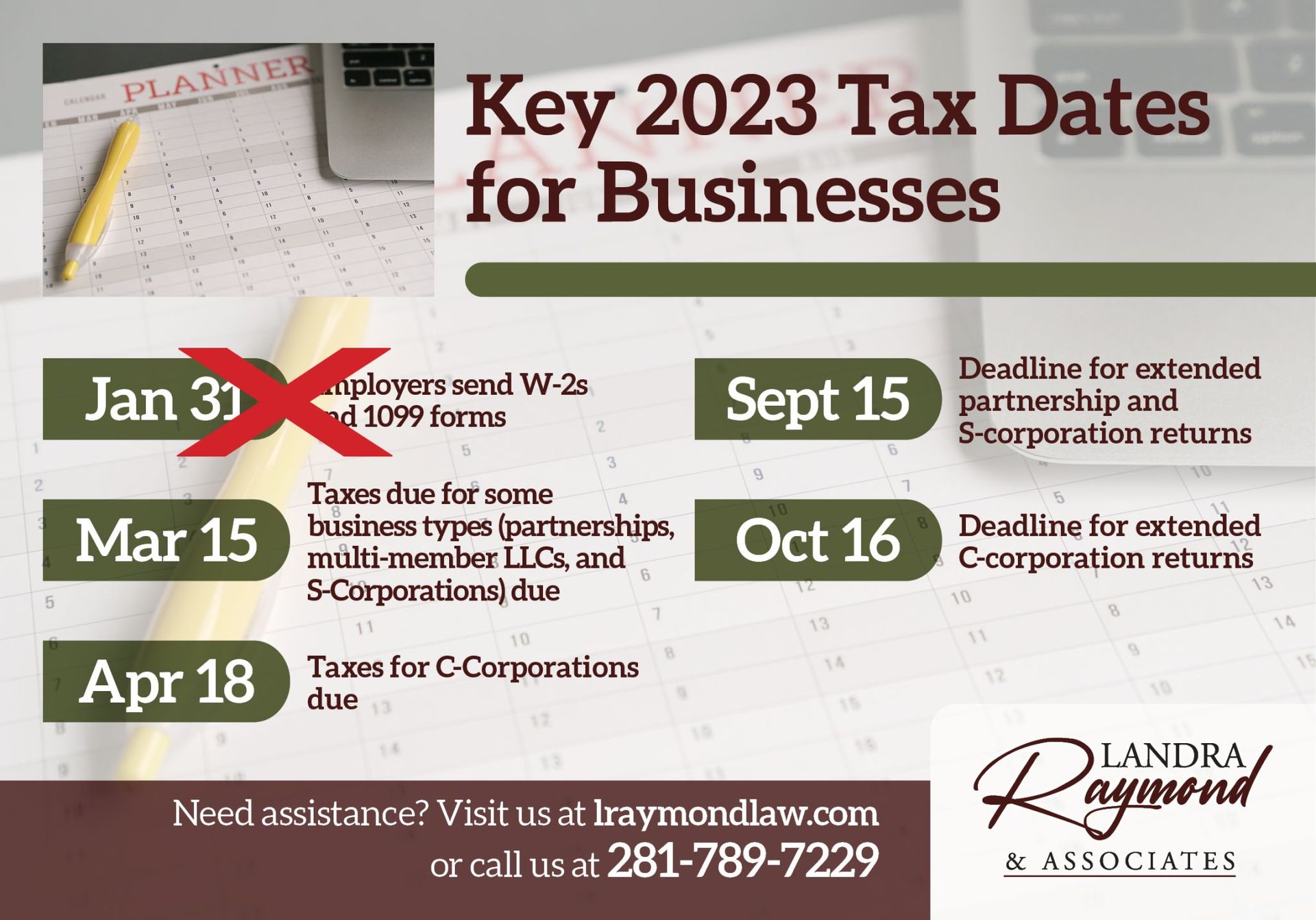

Hire An Accounting Professional

If you’d like help understanding the new tax codes or just want to let someone handle everything for you, it may be time to bring in an expert. With decades of experience dealing with accounting, tax, and legal projects, the Landra Raymond & Associates team can help.